Problem definition

Cost accounting is defined as the historical reporting of

disbursements and costs and expenditures on a project. When applied to a

current project assists in giving precise project status. What is the better

technique for cost accounting?

Feasible alternatives

Work breakdown structure (WBS)

Code of Accounts (COA)

Activity based Costing (ABS)

Develop the outcome of each

alternative

Table 1 3D WBS Matrix

2000 Assets 6000 Expences

2100 Cash 6100

Cost of products sold

2200 Accounts Receivable 6200

Salaries and wages

2300 Notes Receivable 6300

Heat, light, and power

2400 Inventory – materials and supplies 6400Communications expence

2500 Inventory – finished products 6500 Insurance

2600 Work-in-progress 6600

Insurance

2700 Equipment 6700

Taxes

2800 Buildings and fixtures 6800 Depreciation

2900 Land 6900

Interest expense

3000 Liabilities 7000

Project work in progress

3100 Accounts payable 7100

Structural skid

3200 Notes payable 7200

Piping works

3300 Accrued liabilities

3500 Reserve accounts

4000 Equity

4100 Retained earnings

5000 Reserves

5100 Sales of finished products

5200 Other revenue

Table 3 Typical Code of

Accounts

The attribute for the selection criteria is;

·

Cost visibility

·

Project visibility

·

Cost forecasts

Analysis of alternatives

Code of Accounts summarises costs around business

practices. It classifies various categories of costs incurred in the progress

of a job. It does not provide the visibility needed to manage the work or to

make informed forecasts of the cost of new jobs.

The ABC assigns resources to the activities that are

required to accomplish the cost objective. In this way resources and activities

that are cost drivers are known. Fig. 2 shows resources assignment to

activities.

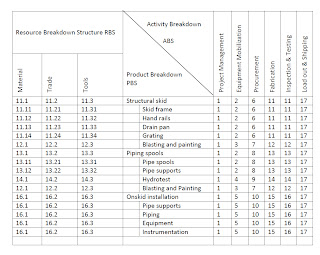

The WBS matrix provides the framework for planning and

controlling the resources needed to accomplish the work and facilitates the

summary of project data regarding the cost and schedule performance cost. Fig. 3 shows matrix of resources, required to

carry out each activity to generate a product.

|

ATTRIBUTES

|

COA

|

ABC

|

WBS

|

|

Cost

Visibility

|

0

|

1

|

1

|

|

Project

Status

|

0

|

0.5

|

1

|

|

Cost

Forecast

|

0

|

0.5

|

1

|

|

|

0

|

2

|

3

|

Selection of preferred alternative

The WBS matrix provides a complete picture of the project

with the costs associated with each subtask broken down to various resource

costs. When used to classify and record costs, the WBS becomes the COST Element

Structure (CES) and fulfills both technical and cost functions. Table 1 above

shows that WBS provides cost visibility, project status and data for cost

forecasts.

Performance monitoring and evaluation

Historical cost records represent the way a company

conducts its business. Analysis of the cost data determines how the company has

performed and to forecast cost trends. A project cost baseline is developed and

is used as a basis of cost monitoring and control.

References

Postula, F. D. Cost Elements, Skills & Knowledge of

Cost Engineering (5th ed.), (PP 1.4-1.6) WV, AACE International

Humphreys, G. C. (2011). Definition of Scope, Work

Breakdown Structure (WBS) and Dictionary, Project Management Using Earned Value

(2nd ed.), (PP. 45-58) CA, Humphreys & Associates Inc.

Humphreys, G. C. (2011). Collecting Actual Cost, Project

Management Using Earned Value (2nd ed.), (PP. 531-543) CA, Humphreys

& Associates Inc.

Sullivan, W.G., Wicks, E.M., & Koelling, C.P. (2012).

Decision Making Considering Multiattributes, Engineering Economy (15th ed.), (PP 582-584)

New Jersey, NJ. Pearson Higher Education, Inc.

AWESOME, Charlie......

ReplyDeleteNice work following our 7 step process and a perfect job in citing your references using APA format.

Not anything else I can ask from you!!

BR,

Dr. PDG, Jakarta